The Cryptocurrency Craze: Boom or Bust? Navigating the Wild World of Digital Assets

Cryptocurrency, the buzzword of the decade, has captivated the world with its meteoric rise and volatile swings.

Cryptocurrency, the buzzword of the decade, has captivated the world with its meteoric rise and volatile swings. From Bitcoin's record-breaking highs to the recent market crash, the question on everyone's lips is: Is cryptocurrency a booming revolution or a fleeting fad destined to bust? Let's delve into the current state of cryptocurrency, analyzing its potential risks and rewards to help you navigate this complex landscape.

The Alluring Potential:

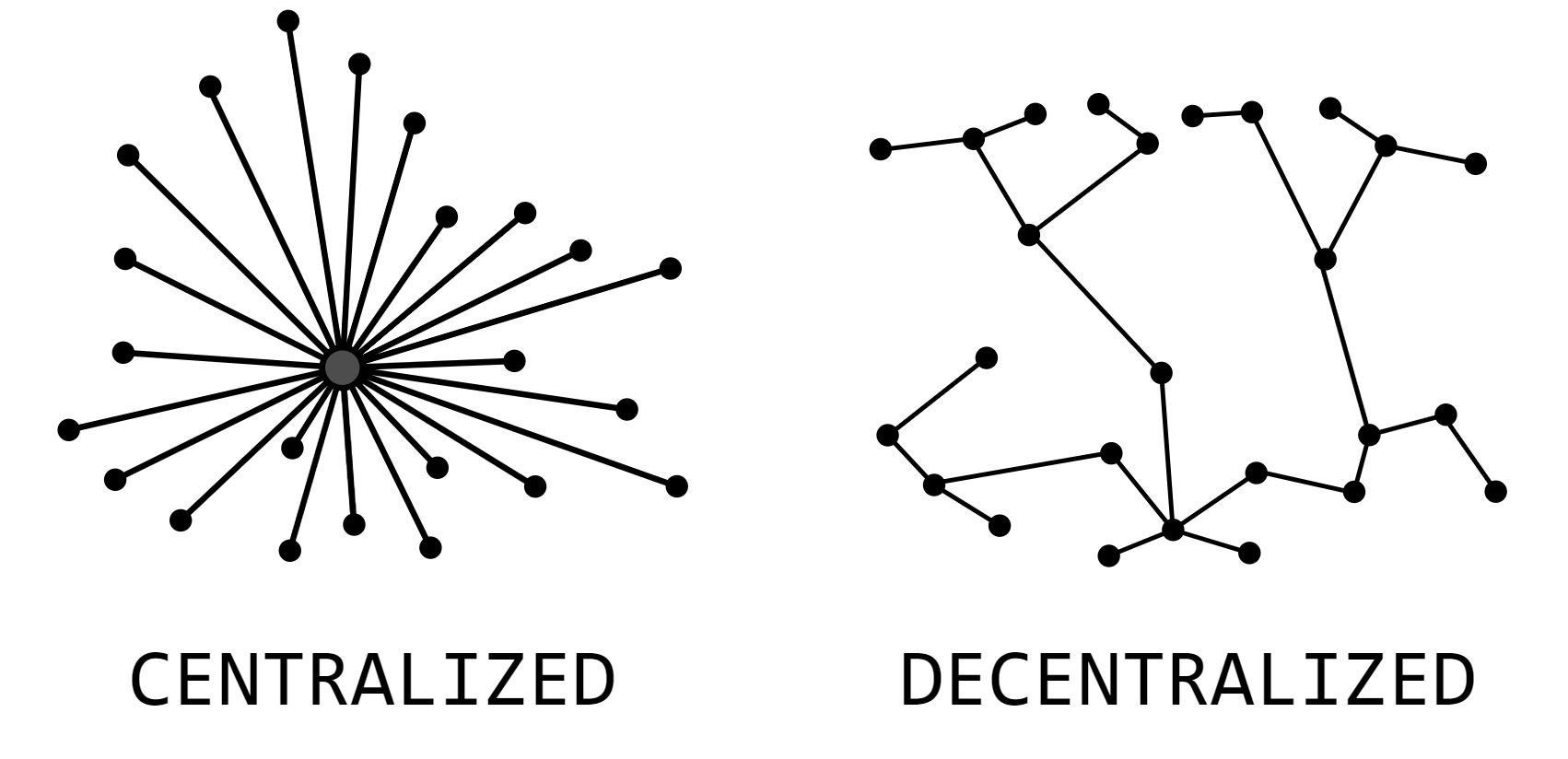

Decentralization

Cryptocurrencies operate on decentralized networks, offering freedom from government intervention and potential censorship. Unlike traditional currencies controlled by central banks, the decentralized nature of cryptocurrencies empowers users with greater control over their financial assets. This aspect has resonated with many who seek autonomy and transparency in their financial transactions.

Borderless Transactions

One of the most appealing features of cryptocurrencies is their ability to facilitate borderless transactions. Traditional financial systems often involve lengthy processing times and high fees for international transfers. However, cryptocurrencies enable fast and low-cost transactions across geographical boundaries, making them ideal for global commerce and remittances.

Transparency and Security

Blockchain technology, the underlying technology of cryptocurrencies, provides a transparent and secure record of transactions. Each transaction is recorded on a decentralized ledger, which is immutable and transparent to all participants in the network. This level of transparency reduces the risk of fraud and manipulation, instilling trust among users.

Potential for High Returns

The early adopters of cryptocurrencies, particularly Bitcoin, have witnessed remarkable returns on their investments. The exponential growth of the cryptocurrency market has attracted investors seeking high returns in a relatively short period. While past performance is not indicative of future results, the potential for significant gains remains a driving force behind the cryptocurrency craze.

Innovation and Disruption

Cryptocurrencies and blockchain technology have the potential to disrupt various industries, from finance to supply chain management. The decentralized and transparent nature of blockchain offers new possibilities for streamlining processes, reducing costs, and increasing efficiency. As innovators explore the capabilities of blockchain, the potential for transformative change across industries continues to grow.

The Looming Risks:

Volatility

The cryptocurrency market is notorious for its volatility, characterized by rapid and unpredictable price fluctuations. Extreme volatility can lead to substantial gains for investors but also carries inherent risks. Sudden price crashes can result in significant losses for those unprepared for market turbulence.

Regulation

Governments worldwide are grappling with how to regulate cryptocurrencies, leading to uncertainty and potential restrictions. Regulatory actions, such as bans on cryptocurrency exchanges or strict KYC (Know Your Customer) requirements, can impact market sentiment and investor confidence.

Security Hacks

Cryptocurrency exchanges and wallets have been frequent targets of cyberattacks, resulting in the theft of millions of dollars worth of digital assets. Security breaches highlight the vulnerability of centralized platforms and underscore the importance of robust security measures in safeguarding cryptocurrency holdings.

Environmental Impact

Proof-of-work mining, the consensus mechanism used by some cryptocurrencies, consumes vast amounts of energy, raising concerns about its environmental impact. The energy-intensive nature of mining operations contributes to carbon emissions and exacerbates environmental degradation.

Scams and Fraud

The unregulated nature of the cryptocurrency market has created fertile ground for scams and fraudulent schemes. From Ponzi schemes to fake ICOs (Initial Coin Offerings), unsuspecting investors are at risk of falling victim to sophisticated scams. The lack of regulatory oversight leaves investors vulnerable to exploitation and financial loss.

Navigating the Maze:

Despite the risks, cryptocurrency holds undeniable potential for the future. However, before diving in, consider these key points:

- Do Your Research: Understand the specific characteristics and risks of different cryptocurrencies before investing. Conduct thorough research and seek advice from reputable sources to make informed investment decisions.

- Invest Only What You Can Afford to Lose: Cryptocurrencies are inherently volatile, and investing more than you can afford to lose can lead to financial hardship. Exercise caution and only invest funds that you can afford to risk.

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies and asset classes to mitigate risk and optimize returns. Diversification helps protect your portfolio from the impact of market volatility and reduces exposure to individual assets.

- Beware of Scams: Be vigilant and skeptical of unsolicited investment offers and promises of guaranteed returns. Educate yourself about common scams and fraudulent schemes prevalent in the cryptocurrency space, and always conduct due diligence before investing.

- Stay Informed: Stay abreast of the latest developments in the cryptocurrency market and regulatory landscape. Subscribe to reputable news sources, forums, and social media channels to stay informed about market trends, emerging technologies, and regulatory changes.

The Verdict: Boom or Bust?

Predicting the future of cryptocurrency is challenging, as the market is influenced by numerous factors, including technological advancements, regulatory developments, and investor sentiment. While the risks are substantial, the potential for innovation and disruption cannot be ignored. As an investor, approach cryptocurrency with caution, informed research, and a long-term perspective. While cryptocurrency may offer lucrative opportunities, it is essential to recognize its inherent risks and exercise prudence in investment decisions. Ultimately, whether cryptocurrency experiences a long-term boom or a bust depends on its ability to overcome challenges, gain widespread adoption, and realize its transformative potential in the digital economy.