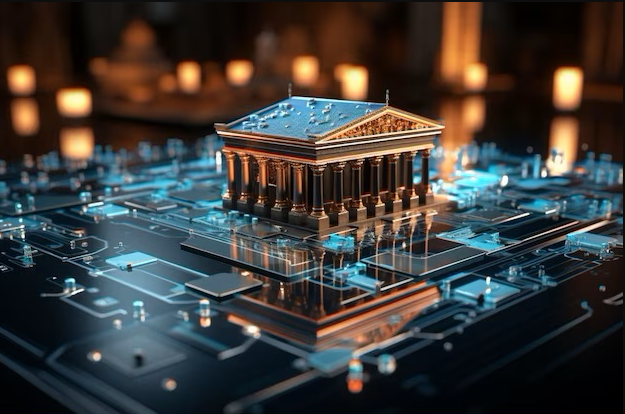

How Technology is Changing the Face of Finance and Investment

Whether you're a beginner or an experienced investor, it’s important to understand how these advancements are shaping the future of finance.

The intersection of technology and finance has led to massive changes in how we think about money management, investment, and even wealth building. With just a few taps on your smartphone, you can now manage your investments, trade on global markets, and use tools that once were only available to professionals. Whether you're a beginner or an experienced investor, it’s important to understand how these advancements are shaping the future of finance.

Let’s take a closer look at some of the key innovations that are transforming the industry.

1. Fintech Platforms Making Finance More Accessible

Gone are the days when you needed an appointment with a financial advisor or broker to start investing. Fintech platforms have opened the doors to everyday users, allowing them to access financial tools that were previously reserved for experts. Whether it’s managing budgets, investing in stocks, or trading cryptocurrencies, technology has leveled the playing field.

Many platforms today offer easy-to-use interfaces that simplify the investment process. These innovations make it possible for anyone with an internet connection to dip their toes into the world of trading, whether it's through traditional stock markets or newer, more complex tools like cryptocurrency trading.

2. Automated Trading: Letting Tech Do the Work

One of the most revolutionary developments in finance has been the introduction of automated trading systems. These systems, often referred to as trading bots, can automatically buy and sell assets based on predefined strategies. This allows investors to take advantage of market movements without having to monitor their screens 24/7.

For people who are just starting out or simply don’t have the time to manage their trades manually, this is a game changer. Automated trading takes some of the emotion out of the equation, helping investors stick to a strategy and avoid impulsive decisions that might result in losses.

3. The Power of Mobile Trading

Our smartphones are the gateway to almost every aspect of our lives these days, and trading is no exception. Mobile trading apps have grown in popularity, giving people the flexibility to manage their investments from anywhere. Whether you’re on a lunch break, commuting, or even traveling, you can check market trends and execute trades in real-time.

This flexibility means that trading is no longer limited to professionals sitting in front of multiple computer screens all day. Instead, anyone with a smartphone can participate in financial markets, opening up opportunities to those who otherwise might not have considered investing.

4. Data-Driven Decisions with Advanced Analytics

Another significant advancement in finance is the availability of advanced analytical tools. In the past, financial analysis was the domain of experienced professionals with access to expensive software and proprietary data. Today, even retail investors can leverage analytics to make more informed decisions.

Trading platforms are increasingly integrating features like market indicators, real-time data, and forecasting tools to help users better understand market behavior. These tools allow investors to plan trades with a deeper understanding of the trends affecting their investments, ultimately leading to more strategic financial decisions.

5. Global Participation in Financial Markets

Finally, one of the most exciting changes technology has brought to finance is the ability to participate in global markets, regardless of where you live. Trading is no longer limited by geography. You can invest in foreign stocks, trade forex, or even explore emerging markets, all from the comfort of your home.

These innovations are especially powerful for those interested in diversifying their portfolios beyond domestic assets. By leveraging online trading platforms, individuals can tap into new opportunities and trends that might otherwise be out of reach.

Conclusion

Technology has fundamentally changed how we interact with finance, making it more accessible, efficient, and data-driven than ever before. Whether you’re just beginning your investment journey or looking to automate your trades, fintech innovations are making it easier for everyone to take control of their financial future.

If you're interested in exploring some of these innovations, platforms like Deriv offer tools like automated trading systems and mobile apps that can help you engage with global markets, often without the steep learning curve. These advances make it possible to practice and refine your strategies in a low-risk environment, such as with Deriv's demo accounts.

As technology continues to evolve, keeping up with these tools will help you stay ahead of the curve in the rapidly changing financial landscape.

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose