Choosing the Optimal Retirement Account: A Comprehensive Guide

Retirement planning is a pivotal aspect of securing a comfortable and worry-free future

Retirement planning is a pivotal aspect of securing a comfortable and worry-free future. Selecting the best retirement account tailored to your unique needs and aspirations is a critical step in this journey. In this comprehensive guide, we, as your dedicated financial allies, unravel the intricacies of retirement account selection, ensuring you make informed decisions aligned with your financial goals.

Understanding the Landscape: Types of Retirement Accounts

Traditional Individual Retirement Account (IRA)

The venerable Traditional IRA is a stalwart in the retirement account arena. Contributions are often tax-deductible, offering an immediate financial benefit. As your investments grow, taxes are deferred until withdrawal during retirement, potentially resulting in a lower tax burden.

Roth Individual Retirement Account (Roth IRA)

Contrastingly, the Roth IRA operates on a post-tax contribution model. While contributions are not tax-deductible, the real magic happens during withdrawals—qualified distributions are entirely tax-free, providing a valuable tax shield in retirement.

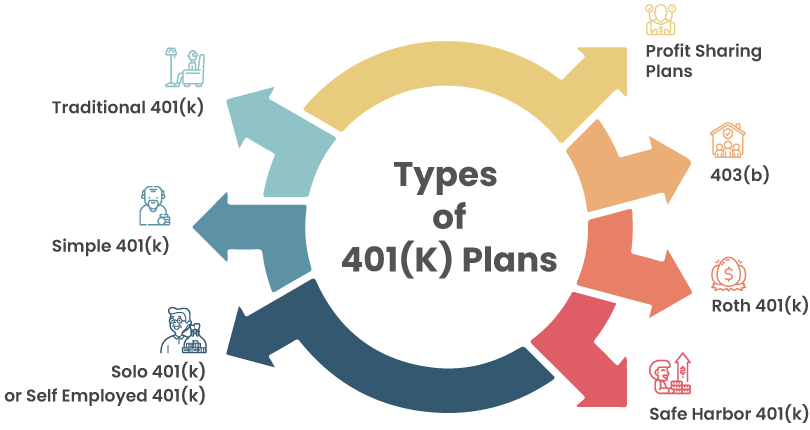

401(k) Plans

Employer-sponsored 401(k) plans are a cornerstone for many employees. They offer tax advantages similar to Traditional IRAs but with the added perk of potential employer contributions, effectively doubling the impact of your retirement savings.

Simplified Employee Pension IRA (SEP IRA) and SIMPLE IRA

Entrepreneurs and small business owners can explore the benefits of SEP IRAs and SIMPLE IRAs. These plans provide simplified contribution processes and offer tax advantages for both employers and employees, fostering a robust retirement nest egg.

Decoding Your Goals: Matching Retirement Accounts to Aspirations

Tax Considerations

For those seeking immediate tax benefits, the Traditional IRA and 401(k) plans stand out. However, if you anticipate being in a higher tax bracket during retirement or aim for tax-free withdrawals, the Roth IRA becomes an appealing choice.

Employer Contributions and Matching

Employees should keenly evaluate employer-sponsored plans. If your employer offers a 401(k) matching program, it's akin to free money. Maximize contributions to meet the employer match, capitalizing on this valuable benefit.

Flexibility in Contributions

Entrepreneurs and freelancers may find solace in the flexibility offered by SEP IRAs and SIMPLE IRAs. These plans allow for substantial contributions, accommodating the unpredictability of income often associated with self-employment.

Navigating the Complexities: Factors Influencing Your Decision

Risk Tolerance and Investment Options

Evaluate your risk tolerance and desired level of involvement in investment decisions. IRAs often provide a broader range of investment options compared to employer-sponsored plans, affording more control over your portfolio.

Withdrawal Rules and Penalties

Understand the withdrawal rules associated with each retirement account. While IRAs offer more flexibility in early withdrawals, they may incur penalties. Conversely, 401(k) plans often have more rigid withdrawal structures.

Estate Planning Considerations

For those with estate planning in mind, the Roth IRA's lack of required minimum distributions (RMDs) during the account holder's lifetime can be advantageous. This allows for potential wealth transfer to heirs without the burden of forced withdrawals.

Strategic Steps for Decision-making

Conduct a Comprehensive Financial Assessment

Start by understanding your current financial landscape. Analyze your income, expenses, and existing retirement savings. This serves as the foundation for determining how much you can realistically contribute to your retirement account.

Project Your Retirement Lifestyle

Envisioning your retirement lifestyle aids in setting realistic financial goals. Consider factors such as travel, healthcare, and potential hobbies. This foresight informs the amount of money you'll need and the best retirement account to support these aspirations.

Seek Professional Guidance

When in doubt, seek the counsel of financial advisors. They can provide personalized advice based on your unique circumstances, ensuring your chosen retirement account aligns seamlessly with your broader financial strategy.

Conclusion: Crafting Your Financial Legacy

In conclusion, the journey to selecting the best retirement account is a personalized expedition. Consider your current financial standing, future aspirations, and the intricate details of each retirement account. Whether it's the immediate tax benefits of a Traditional IRA, the tax-free withdrawals of a Roth IRA, or the employer-matched contributions of a 401(k), your choice today shapes the quality of your retirement tomorrow.

As you embark on this financial voyage, remember that informed decisions pave the way for a secure and fulfilling retirement. The power to craft your financial legacy lies in the nuances of your retirement account choice.